By: Charles-Antoine Germain and Lea Charron-Duhamel

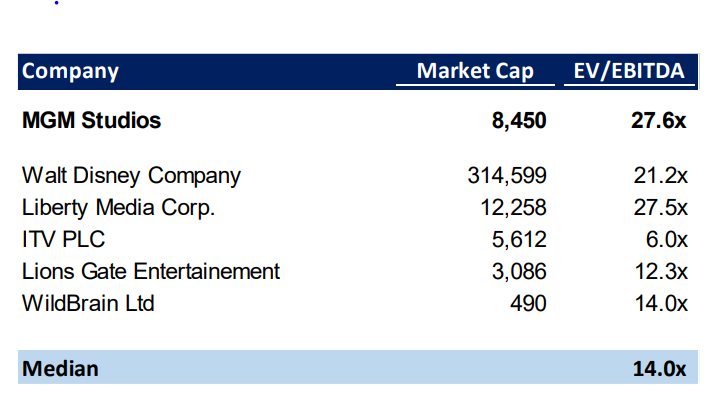

On May 26th 2021, Amazon Inc (NAS:AMZN) announced the acquisition of Metro-Goldwyn-Mayer Studios, or MGM Studios, from its parent company, MGM Holdings. The proposed transaction would have a value of $8.45B paid in cash by Amazon, pricing MGM Studios at an EV/EBITDA multiple of 27.62x.

Amazon’s Rationale

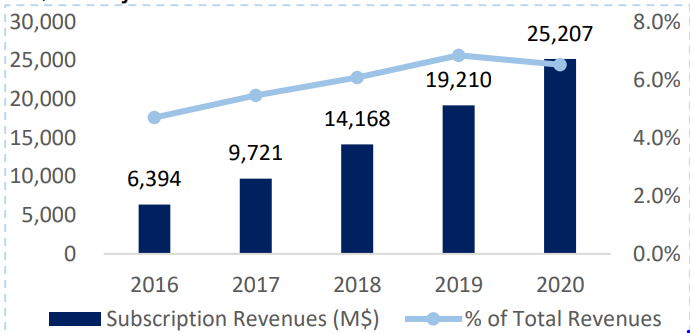

Since 2016, Amazon’s subscription service (Prime) has grown at rate of 40.9% per year from $6.4B in 2016 to $25.2B. It went from representing 4.7% of total revenues in 2016 to 6.5% in 2020. As Prime has the potential of becoming a more important driver of revenues, it is judicious from Amazon to make additional investments in the segment. In fact, the acquisition of MGM Studios would add a significant quantity of proprietary content which would increase the value of the product. This might also be part of a bigger transition of Prime. Traditionally, the product’s main offer was quicker shipping. The company eventually added a streaming service as part of an additional benefit for subscribers. However, as the company keeps developing its library of intellectual properties, the streaming service could become an important part of the membership offering and compete against other streaming platforms like Netflix and Disney+.

Furthermore, a growth in Prime memberships would not only increase Amazon’s membership revenues but could also lead to additional growth in other segments through cross-selling opportunities. Using this strategy, Amazon could extract more value from MGM Studios than MGM Holdings ever could.

Finally, Amazon could benefit from MGM’s human capital. While it is unclear why Amazon chose to grow its video offering through an acquisition instead of additional investment in Amazon Studios, some people have speculated that it is due to Amazon Studios’ lack of success. Since 2017, this Amazon subsidiary has gone through multiple changes in management. Furthermore, very few of Prime Video’s hits came from Amazon Studios as most of them were acquired from external studios. While Amazon has never admitted its disappointment toward its own studios, Amazon Studios seem to have underperformed its competitors in the last few years, and the new acquisition is potential opportunity to turn the situation around.

Competitive Landscape

Since Netflix’s rise in popularity skyrocketed in 2016, it has become Amazon Prime’s biggest competitor. Throughout the years, the competition has only tightened with numerous production companies starting their own streaming services. Netflix and Amazon Prime’s biggest loss came when Disney Plus was launched in November 2019. Competitive advantage between streaming services companies do not come from pricing, as pricing across platforms tends to be extremely similar. Rather, competitive advantage come from their product offerings, either owning rights of popular tv shows and movies or creating their own content. Making acquisitions to expand their product offering is a common strategy employed by many of Amazon Prime’s competitors. In 2019, Disney purchased Fox, then considered the fifth biggest film studio, for $71.3 billion. This M&A deal expanded Disney’s library of video content which now includes The Simpsons, Family Guy and Home Alone. Similarly, in September 2021, Netflix acquired Roald Dahl Story Co. which owns The Chocolate Factory and Mathilda. With those rights acquired, Netflix has more creativity with its product offering. For example, it now has the ability to expand their kids catalogue since Dahl has had success in that area. Hence, because of the competitive nature of the industry, the value of the MGM acquisition deal comes from MGM’s catalogue of 4,000 films and most notably partial film rights to the James Bond franchise. Based on comparative multiples, it was acquired at a significant premium. However, the combination of its offering and outstanding management as demonstrated by its above industry average EV/EBITDA help justify such value.